80 + 40 = 0

Nobody expects great math skills from the Beacon Hill politicians. The numbers they're throwing around lately, however, especially defy logic.

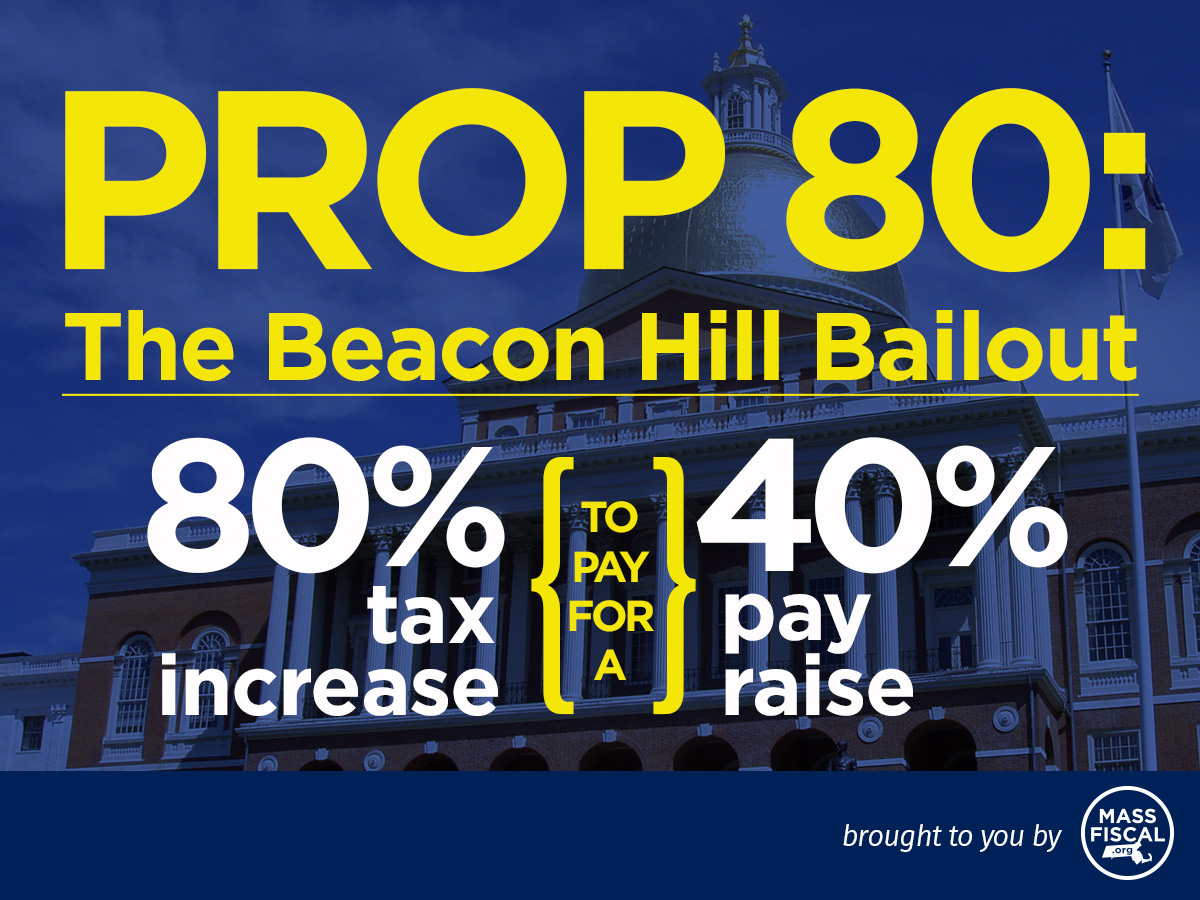

Proposition 80, the graduated income tax proposal, would raise taxes on the state's top producers by 80 percent. To prepare for it, the Legislature voted themselves a fat 40 percent pay increase first thing this session.

The cynical lawmakers voted for the pay raise early in a new session because they believe voters will forget. The pols believe they won't be held accountable for putting their own wallets before the people's business. It’s a Beacon Hill Bailout.

And they're trying to sell the people on a big tax increase for services, ignoring the burden their nest feathering put on the state's already strained budget.

How do those two things add up? Zero accountability, that's how.

At least that's how the Beacon Hill Gang planned things. But we're going to demand accountability. Click here to see the results of our recent poll. When citizens have the information about Prop. 80 and the Pay Raise vote, they'll hold lawmakers accountable.

Facts on Prop. 80:

-Prop. 80 is an 80 percent tax increase on some of the state’s highest earners.

-It would be a Beacon Hill bailout, collecting two billion dollars in new taxes.

-It would force the state to collect 30 percent of the state budget revenue from less than 20,000 taxpayers, creating a very unstable economic outlook.

-It would be the first time the state constitution was amended to include a tax increase.

-There are no legal guarantees that the money collected from the tax increase would go toward additional money toward “education” and “transportation” as the proponents have falsely stated.

-Notable Republicans, Democrats, conservatives, progressives, moderates, and good government advocates are opposing Prop. 80.

-The major financial backer to Prop. 80 are unions.

-Similar graduated income tax schemes have been placed as ballot questions in Massachusetts and have failed on every occasion, for a total of five times.

-In 2000 voters voted to reduce the income tax rate to 5 percent.

-Before being placed on the November 2018 ballot, it will probably be challenged in court as unconstitutional.

-To see how your lawmakers in the House voted on Prop. 80 in 2017, click here, Senate vote here. For the House and Senate votes in 2016, click here and here.

Facts on the Pay Raise Vote:

-The first major vote lawmakers took during this legislative session, even before they voted on the rules for the legislature, was to give themselves a pay raise.

-The legislature did not conduct a single hearing before voting to give themselves a pay raise to ask where the money would come from.

-The legislature appointed a commission to determine they deserved a pay raise.

-The Senate President, Stanley Rosenberg, is the highest paid state lawmaker.

-On average, lawmakers receive a 40 percent pay raise.

-Included in the pay raise, was a more than doubling of their expenses allowances, which they do not need to show proof of expenses. Some lawmakers can earn up to an extra $20,000.

-For freshman lawmakers, this was their first significant vote.

-Lawmakers treated the pay raise vote as an “emergency” bill which allows them to collect retroactive pay.

-Lawmakers added the courts into the pay raise scheme, which virtually prevents it from being repealed as a citizen initiative petition.

-Governor Charlie Baker vetoed the pay raises, but the legislative overrode the Governor’s veto. The Governor described the pay raises as “fiscally irresponsible.”

-To see how your lawmaker in the House voted on the pay raise vote, click here, for the Senate vote click here. To see how your lawmaker in the House and Senate voted on overriding the Governor’s veto of the pay raise vote, click here and here.